一切从简,目的只是想算出一个大慨。

为何:因为, Graham never intended this formula to be used to evaluate stocks.

Benjamin Graham formula

Note that Graham never intended this formula to be used to evaluate stocks.[3]

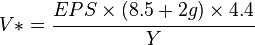

The formula as described by Graham in the 1962 edition of Security Analysis, is as follows:

V = Intrinsic Value

EPS = Trailing Twelve Months Earnings Per Share

8.5 = P/E base for a no-growth company

g = reasonably expected 7 to 10 year growth rate

Where the expected annual growth rate "should be that expected over the next seven to ten years." Graham’s formula took no account of prevailing interest rates.

An RGV of less than one indicates an overvalued stock and should not be bought, while an RGV of greater than one indicates an undervalued stock and should be bought.

Because of the measures it uses, difficulties may be encountered in evaluating both new and small company stocks using this model as well as any stock with inconsistent EPS growth. On one hand, it is efficient because of its simplicity but on the other, it is limited by its simplicity because the model does not work well for every stock.

Thus, the calculation is subjective when considered on its own. It should never be used in isolation; the investor must take into account other factors such as:

为何要加 每股自由现金流, 减每股借贷呢?

因为,如果两间同样成长率,同样每股赚益的公司,

一间有净现金,另一间却债台高筑,

用这方程式,intrinsic value = eps x ( 8.5 + 2g), 得到的答案是一样的。

这就偏差了,因此,稍作补充。

用这方程式, intrinsic value = eps X (8.5 + 2g),

得到鹏发的内在价值 RM7.14。

欢迎网友们点评以上的算法。

得到的鹏发内在价值却是 7.14 X 0.97 = RM6.93

Formula calculation

In The Intelligent Investor, Benjamin Graham describes a formula he used to value stocks. He disregarded complicated calculations and kept his formula simple. In his words: "Our study of the various methods has led us to suggest a foreshortened and quite simple formula for the evaluation of growth stocks, which is intended to produce figures fairly close to those resulting from the more refined mathematical calculations."The formula as described by Graham in the 1962 edition of Security Analysis, is as follows:

V = Intrinsic Value

EPS = Trailing Twelve Months Earnings Per Share

8.5 = P/E base for a no-growth company

g = reasonably expected 7 to 10 year growth rate

Where the expected annual growth rate "should be that expected over the next seven to ten years." Graham’s formula took no account of prevailing interest rates.

Application

To apply this approach to a buy-sell decision, each company’s relative Graham value (RGV) can be determined by dividing the stock’s intrinsic value V* by its current price P:

An RGV of less than one indicates an overvalued stock and should not be bought, while an RGV of greater than one indicates an undervalued stock and should be bought.

Because of the measures it uses, difficulties may be encountered in evaluating both new and small company stocks using this model as well as any stock with inconsistent EPS growth. On one hand, it is efficient because of its simplicity but on the other, it is limited by its simplicity because the model does not work well for every stock.

Thus, the calculation is subjective when considered on its own. It should never be used in isolation; the investor must take into account other factors such as:

- Net Current Asset Value in order to determine the financial viability of the firm in question

- Current Asset Value in order to determine short-term financial viability of the firm

- Debt to equity ratio

- Quality of the Current Assets.

了解了内在价值方程式后,让我们采用最简单的方程式 来算算鹏发的内在价值。

intrinsic value = eps x ( 8.5 + 2g)

在此先算鹏发的成长率, g.

我采用最简易的,每股盈利,eps 算,

Year

|

Eps (sen)

|

Eps grow

|

Eps grow %

| |

2004

|

12

|

12

| ||

2005

|

13

|

13-12=1

|

1/12

|

8

|

2006

|

13

|

13-13=0

|

0/13

|

0

|

2007

|

30

|

30-13=17

|

17/13

|

131

|

2008

|

30

|

30-30=0

|

0/30

|

0

|

2009

|

14

|

14-30= -16

|

-16/30

|

-53

|

2010

|

26

|

26-14=12

|

12/14

|

86

|

2011

|

41

|

41-26=15

|

15/26

|

58

|

2012

|

45

|

45-41=4

|

4/41

|

10

|

2013

|

65

|

65-45=20

|

20/45

|

44

|

Total

|

289sen

|

284%

|

平均过去十年每股收益成长率, g

=( 8 + 0 + 131 + 0 – 53 + 86 + 58 + 10 + 44 )/ 9

= 284 / 9 = 32%

g= 32% = 0.32

eps = 65sen (2013财政年)

鹏发的内在价值 ,

=65sen x ( 8.5 + 2 x 0.32 ) + ( 96,067,723 / 80,064,000 ) - 0

= 65sen x 9.14 + 120sen per share

= 594.1sen + 120sen

= RM7.14

为何要加 每股自由现金流, 减每股借贷呢?

因为,如果两间同样成长率,同样每股赚益的公司,

一间有净现金,另一间却债台高筑,

用这方程式,intrinsic value = eps x ( 8.5 + 2g), 得到的答案是一样的。

这就偏差了,因此,稍作补充。

用这方程式, intrinsic value = eps X (8.5 + 2g),

得到鹏发的内在价值 RM7.14。

欢迎网友们点评以上的算法。

要是我们采用修订的方程式,

4.4: the average yield of high-grade corporate bonds in 1962, when this model was introduced

4.4 是在 1962年,现在大慨也是如此

Y: the current yield on AAA corporate bonds = 4.54, 是从moody取得。

因此 4.4 / 4.54 = 0.97, 或接近 1。

得到的鹏发内在价值却是 7.14 X 0.97 = RM6.93

1 comment:

谢谢分享

Post a Comment